… what are the implications for marketers and the world?

The online shift in advertising budget from offline TV and print ads to digital media has been one of the biggest changes that we have witnessed with the growth of the Internet. Nothing new here, this has happened gradually as spend has shifted from offline media sites to their online equivalents.

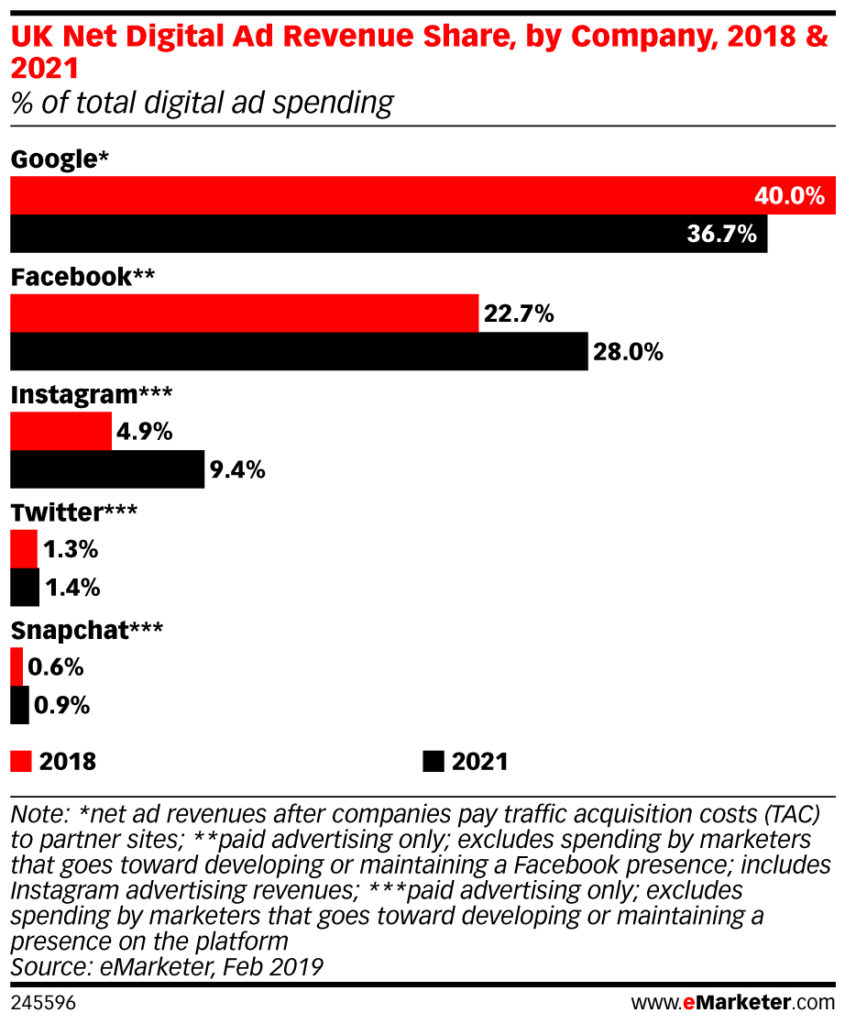

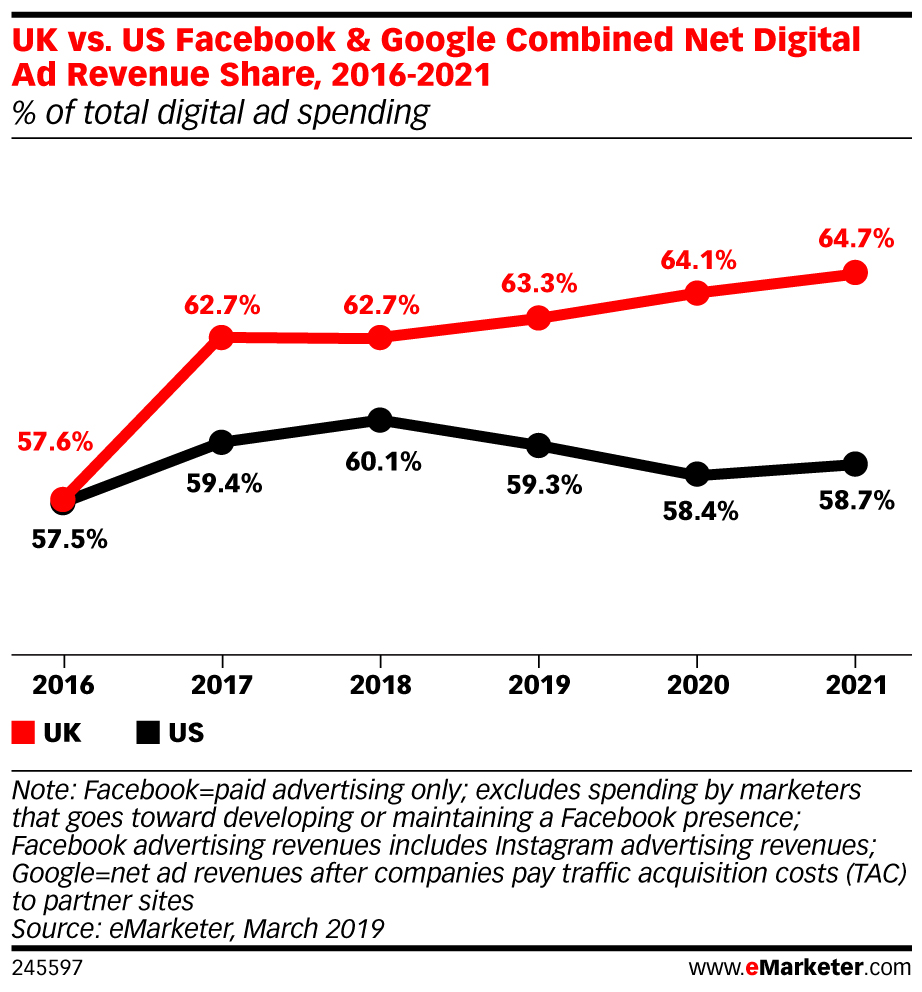

What has shocked me in recent years, has been the growing hegemony of the two biggest online platforms globally, that’s Facebook and Google. This is most marked in English-speaking countries, so let’s look at the UK.

This recent eMarketer post, Facebook and Google Control Ever-Greater Portion of UK Ad Market reported in Campaign brought home to me just how successful Facebook and Google are today in capturing advertising spend from businesses:

“Facebook and Google account for a huge 66.7% of digital advertising revenue in the United Kingdom (including Facebook-owned Instagram)”.

So, that’s over two-thirds of ad spend…

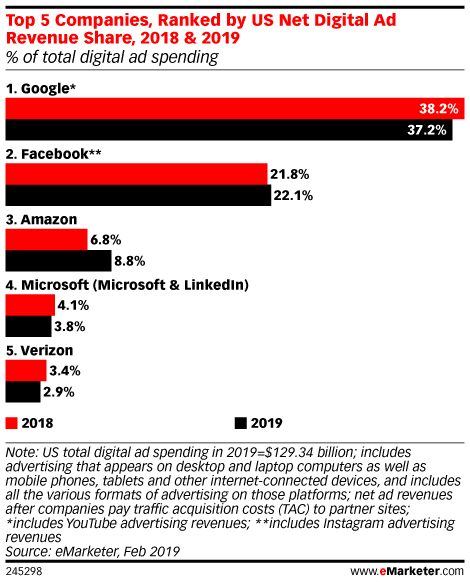

If you look at the situation in the United States, again via eMarketer ad research, it’s at a similar, but slightly lower level.

In the US, their dominance is partly because of the growing influence of Amazon as this research shows.

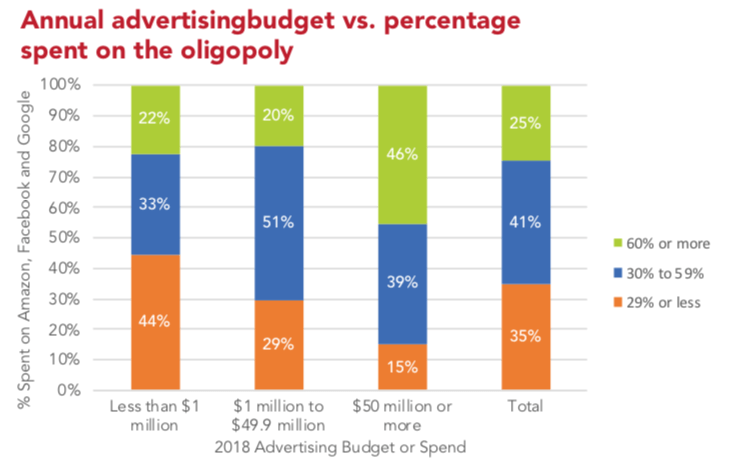

A different angle on this picture of Amazon, Facebook and Google ad budget dominance is provided in new research reported in Marketing Land by Lawless Research and Factual. They say:

“The advertising oligopoly of Google, Facebook and Amazon is shown by this survey of 700 respondents, spending on average, 43% of their ad budgets on the three platforms.”

The research shows that there is less spend on these platforms in smaller companies. This may potentially be because of smaller B2B companies focusing on spending on LinkedIn advertising who incidentally dominate that category via their parent Microsoft.

What are the implications of this imbalance?

I wanted to flag up the latest data on this, since it’s a great discussion point for students studying marketing and of course it’s a challenge for businesses. One implication is that for now, if you work in marketing or aspire to, understanding the complex options available in Facebook and Google and how to optimize them is essential. Yes, you may use an agency, or employ specialists, but you have to ask them the tough questions to optimize your spend.

Marketing Land call it out as an oligopoly, I called it a hegemony, neither is positive. If you take at the synonyms, it stands for: leadership, dominance, dominion, supremacy, ascendancy, predominance, primacy, authority, mastery, control, power, sway, rule, etc.

Intense competition from businesses on these platforms has caused often incredible fees to be bid for ads, likely when businesses are trying to buy market share, or perhaps, I fear, because they are not tracking ads closely enough, so don’t know they are burning money at silly cost-pre-acquisition rates.

Larger businesses who use media-buying agencies can tap into Programmatic display options to advertise on publisher sites. These options aren’t yet so readily accessible to smaller companies. So their options for advertising on publishers is mediated through Google via Adsense or their rebranded Doubleclick network.

More widely within society, the lack of advertising outside these platforms has meant the demise of many traditional publishers and new online-publishers, with accompanying job losses. Particularly galling since Google and Facebook’s growth has been based on publishers providing content to the platforms for free. That’s not a problem that can be readily solved in the short-term, but anti-trust investigations against these companies and talk of breaking up the companies, both sides of the Atlantic are a step in the right direction.